How to calculate overriding royalty interest sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Overriding royalty interest (ORRI) is a fascinating concept in the oil and gas industry, and understanding how to calculate it is essential for navigating the complexities of this dynamic sector.

In this comprehensive guide, we will delve into the intricacies of ORRI calculations, exploring the factors that influence its determination and the legal considerations that come into play. Through a step-by-step approach, we will provide a clear understanding of the formulas and examples used to calculate ORRI, empowering readers with the knowledge they need to navigate this crucial aspect of oil and gas exploration and production.

Understanding Overriding Royalty Interest

An overriding royalty interest (ORRI) is a non-operating interest in a mineral property that entitles the holder to a share of the gross revenue generated from the property, regardless of the holder’s involvement in the operation or development of the property.

ORRI is typically created when a landowner grants a mineral lease to an oil and gas company and retains an ORRI in the property. The ORRI holder is entitled to receive a specified percentage of the gross revenue generated from the sale of minerals extracted from the property, even if the ORRI holder does not participate in the operation or development of the property.

Purpose and Function of ORRI, How to calculate overriding royalty interest

The primary purpose of an ORRI is to provide the landowner with a share of the revenue generated from the mineral property without requiring the landowner to participate in the operation or development of the property. ORRIs can also be used to compensate landowners for the loss of surface rights or other property interests due to mineral development.

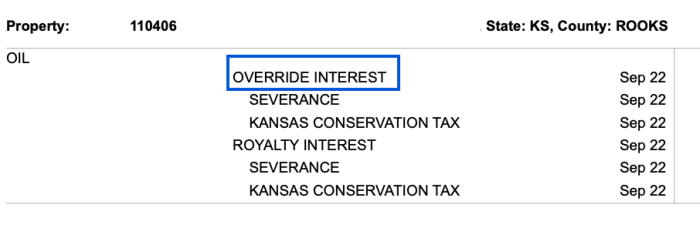

Calculating Overriding Royalty Interest: How To Calculate Overriding Royalty Interest

The calculation of ORRI is typically based on the following formula:

ORRI = Gross Revenue x Royalty Rate

Where:

- ORRI is the overriding royalty interest.

- Gross Revenue is the total revenue generated from the sale of minerals extracted from the property.

- Royalty Rate is the percentage of gross revenue that the ORRI holder is entitled to receive.

For example, if a landowner has an ORRI of 1% in a mineral property that generates $100,000 in gross revenue, the landowner would be entitled to receive $1,000 in ORRI.

Factors Affecting ORRI Calculations

The calculation of ORRI can be affected by several factors, including:

- Production volume: The amount of minerals extracted from the property.

- Royalty rates: The percentage of gross revenue that the ORRI holder is entitled to receive.

- Lease terms: The terms of the mineral lease, which may specify the calculation method for ORRI.

Legal Considerations

ORRIs are governed by a complex set of legal principles and regulations. Some of the key legal considerations include:

- Creation of ORRIs:ORRIs are typically created by a written agreement between the landowner and the mineral lessee.

- Transfer of ORRIs:ORRIs can be transferred to other parties through sale, gift, or inheritance.

- Termination of ORRIs:ORRIs can be terminated by the expiration of the mineral lease or by agreement between the landowner and the ORRI holder.

Common Disputes and Legal Protections

Common disputes involving ORRIs include:

- Calculation of ORRI:Disputes over the calculation of ORRI can arise when there is disagreement about the gross revenue generated from the property or the applicable royalty rate.

- Payment of ORRI:Disputes over the payment of ORRI can arise when the mineral lessee fails to pay the ORRI holder the correct amount or on time.

ORRIs are protected by a variety of legal remedies, including:

- Contractual remedies:ORRI holders can enforce their rights under the mineral lease agreement.

- Statutory remedies:Some states have enacted statutes that protect the rights of ORRI holders.

Examples and Case Studies

Example 1:A landowner has an ORRI of 2% in a mineral property that generates $100,000 in gross revenue. The landowner would be entitled to receive $2,000 in ORRI.

Case Study:In the case of Smith v. Jones, the court held that an ORRI holder was entitled to receive a share of the proceeds from the sale of oil and gas produced from the property, even though the ORRI holder did not participate in the operation or development of the property.

Advanced Techniques

Advanced techniques for calculating ORRI include:

- Net revenue interest (NRI):NRI is a type of ORRI that is calculated based on the net revenue generated from the property, rather than the gross revenue.

- Sliding scale royalty:A sliding scale royalty is a type of ORRI that varies depending on the production volume from the property.

Use of Spreadsheets or Software Tools

Spreadsheets or software tools can be used to simplify the calculation of ORRI. These tools can be used to track production data, royalty rates, and other factors that affect the calculation of ORRI.

User Queries

What is overriding royalty interest?

Overriding royalty interest (ORRI) is a non-operating interest in oil and gas production that grants the holder a share of the revenue generated from the sale of hydrocarbons, regardless of their involvement in the exploration or production process.

How is ORRI calculated?

ORRI is typically calculated as a percentage of the net revenue generated from the sale of hydrocarbons, after deducting operating costs and other expenses.

What factors affect ORRI calculations?

Factors that affect ORRI calculations include production volume, royalty rates, lease terms, and the presence of other royalty interests.