Calculate completing a 1040 answer key – In the realm of taxation, the 1040 Answer Key stands as an invaluable tool, empowering taxpayers with the knowledge and guidance necessary to navigate the complexities of the 1040 form. This comprehensive guide delves into the intricacies of this essential document, providing a roadmap for its accurate completion.

Understanding the purpose and significance of the 1040 Answer Key is paramount. It serves as a reliable reference, offering step-by-step instructions and clarifying the nuances of the 1040 form. By leveraging this resource, taxpayers can avoid common pitfalls and ensure the accuracy of their tax filings.

Overview of 1040 Answer Key

A 1040 answer key is an essential tool for taxpayers who are completing their annual tax return. It provides the correct answers to all of the questions on the 1040 tax form, making it much easier to complete the form accurately and efficiently.

There are several different types of 1040 answer keys available, including online answer keys, downloadable answer keys, and hard copy answer keys.

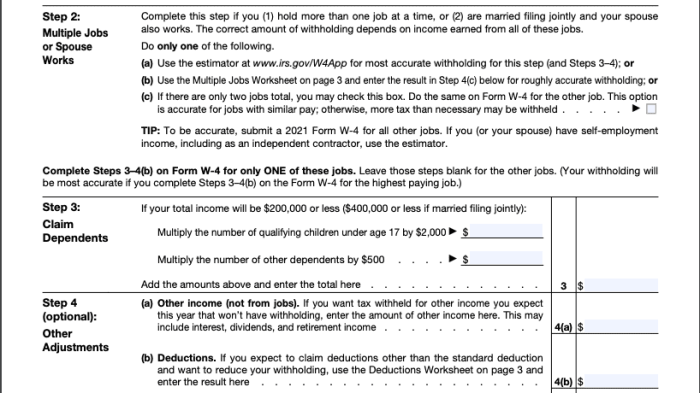

How to Use a 1040 Answer Key

Using a 1040 answer key is relatively straightforward. Simply locate the question that you need help with on the tax form, and then find the corresponding answer in the answer key. The answer key will typically provide a step-by-step explanation of how to arrive at the correct answer, making it easy to understand even for complex tax questions.

Common Errors and Pitfalls, Calculate completing a 1040 answer key

There are a few common errors and pitfalls that can occur when using a 1040 answer key. These include:

- Using the wrong answer key. There are several different versions of the 1040 tax form, and each version has its own unique answer key. It is important to make sure that you are using the correct answer key for the version of the tax form that you are completing.

- Misinterpreting the answer key. The answer key can sometimes be difficult to understand, especially for complex tax questions. If you are unsure about how to interpret the answer key, it is important to seek help from a tax professional.

- Making mistakes when entering the answers. It is important to be careful when entering the answers from the answer key into your tax return. Even a small mistake can result in a significant error on your tax return.

Tips for Completing a 1040

Here are a few tips for completing a 1040 accurately and efficiently:

- Gather all of your tax documents before you begin. This will help you to avoid mistakes and ensure that you have all of the information that you need.

- Use a 1040 answer key. An answer key can help you to answer even the most complex tax questions.

- Take your time. Don’t rush through the tax return. If you are unsure about something, take the time to look it up in the answer key or seek help from a tax professional.

- Double-check your work. Once you have completed the tax return, take some time to review it carefully for any errors.

Resources for Additional Help

If you need additional help with completing your 1040 tax return, there are a number of resources available to you. These include:

- The IRS website. The IRS website has a wealth of information about taxes, including instructions on how to complete the 1040 tax form.

- Tax software. Tax software can help you to complete your tax return quickly and easily. Many tax software programs also include answer keys and other helpful resources.

- Tax professionals. Tax professionals can help you to complete your tax return and ensure that it is accurate and complete.

Query Resolution: Calculate Completing A 1040 Answer Key

What is the purpose of a 1040 Answer Key?

A 1040 Answer Key provides step-by-step instructions and explanations for completing the 1040 form, ensuring accuracy and reducing the risk of errors.

How do I use a 1040 Answer Key?

Refer to the answer key while completing the 1040 form, utilizing the instructions and explanations to guide you through each section.

What are common errors to avoid when using a 1040 Answer Key?

Pay attention to details, ensure accurate calculations, and double-check your work to minimize errors.

When should I seek professional help with completing a 1040?

Consider seeking professional assistance if you encounter complex tax situations, have substantial income or deductions, or need guidance on specific tax laws.